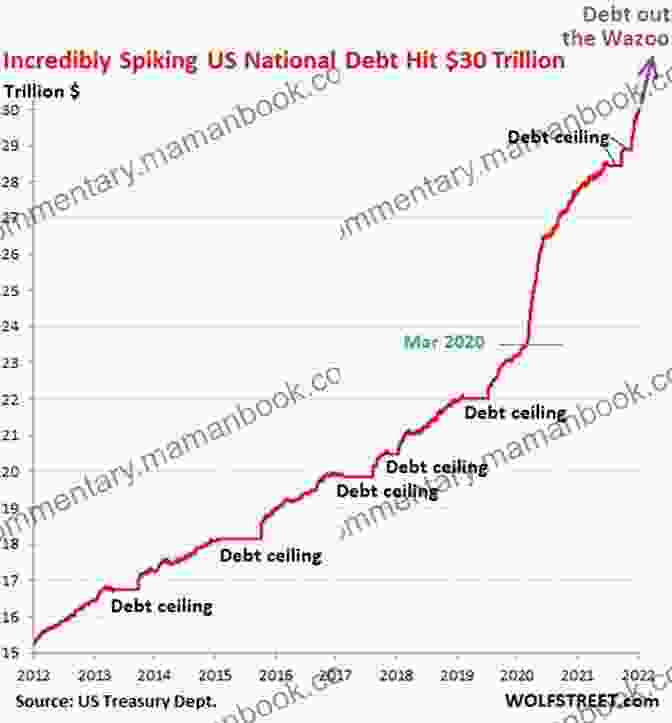

Proven 12-Step Program for Financial Peace of Mind: Achieving Debt-Free Serenity

: The Burden of Debt and the Path to Redemption

Debt, like a heavy cloak, weighs down our shoulders, suffocating our dreams and shattering our peace of mind. It's a relentless cycle that can spiral us into despair and financial ruin. But know this: there is hope. The proven 12-step program outlined in this article will empower you to break free from the shackles of debt and reclaim your financial well-being.

5 out of 5

| Language | : | English |

| File size | : | 417 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 13 pages |

| Lending | : | Enabled |

This comprehensive guide will lead you through a transformative journey of financial recovery, equipping you with the knowledge, strategies, and mindset to tackle debt head-on, improve your relationship with money, and create a future free from financial burden.

Step 1: Acknowledge the Debt Monster

Confronting the reality of your debt is the first step towards conquering it. Take an honest and comprehensive inventory of all your debts, including credit cards, personal loans, student loans, and mortgages. Understanding the magnitude of your debt is crucial for setting realistic goals and devising a repayment plan.

Step 2: Seek Support and Accountability

You don't have to go through this alone. Join a support group or connect with a trusted friend, family member, or financial advisor who understands your struggles. Sharing your experiences, seeking encouragement, and receiving constructive feedback will provide invaluable support along your journey.

Step 3: Create a Realistic Budget

A well-structured budget is the cornerstone of debt management. Track your income and expenses meticulously, categorizing every dollar to identify areas where you can cut back. Prioritize essential expenses like housing, utilities, and food, and allocate funds towards debt repayment.

Step 4: Reduce Unnecessary Expenses

Take a critical look at your lifestyle and identify areas where you can reduce spending. Cut back on non-essential expenses like entertainment, dining out, and subscriptions. Consider negotiating lower bills for services like phone, cable, and internet.

Step 5: Increase Your Income

While reducing expenses is important, increasing your income can accelerate debt repayment. Explore opportunities for overtime, a side hustle, or part-time work. Consider upskilling or pursuing additional education to enhance your earning potential.

Step 6: Consolidate and Refinance Debt

Consolidating multiple debts into a single loan can simplify repayment and potentially lower interest rates. Similarly, refinancing existing loans with lower interest debt can save you thousands in the long run.

Step 7: Negotiate with Creditors

Don't hesitate to reach out to your creditors and explain your financial situation. They may be willing to work with you to create a customized repayment plan that fits your budget. Be prepared to provide documentation of your income and expenses.

Step 8: Seek Professional Help if Needed

If you're struggling to manage your debt on your own, don't hesitate to seek professional help. Credit counselors and non-profit organizations offer confidential guidance, budgeting assistance, and debt management plans.

Step 9: Stay Committed and Motivated

Debt repayment is a marathon, not a sprint. There will be setbacks along the way, but it's crucial to stay committed and motivated. Remember your long-term goals and the sense of financial freedom that awaits you.

Step 10: Improve Your Relationship with Money

Debt is often a symptom of a deeper issue with our relationship with money. Take time to reflect on your spending habits, beliefs, and attitudes towards finance. Work towards developing a healthy relationship with money, based on responsible budgeting, saving, and investing.

Step 11: Build an Emergency Fund

Unexpected expenses can derail your debt repayment efforts. Create an emergency fund to cover unexpected costs, such as medical bills or job loss. Aim to save at least three to six months' worth of living expenses.

Step 12: Celebrate Your Success

As you make progress towards debt freedom, acknowledge and celebrate your achievements. Reward yourself with small non-financial rewards that bring you joy, such as spending time with loved ones or pursuing a hobby. This will help you stay motivated and reinforce positive financial behaviors.

: Embracing Financial Peace of Mind

The journey to debt-free serenity is not always easy, but armed with this proven 12-step program, you have the power to achieve financial peace of mind. Embrace the principles of responsible spending, debt management, and financial well-being, and you will emerge a stronger and more financially secure individual.

Remember, you are not alone in your struggles. With determination, support, and a commitment to financial recovery, you can break free from the shackles of debt and create a life of financial freedom and peace of mind.

5 out of 5

| Language | : | English |

| File size | : | 417 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 13 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Jeffrey Koval Jr

Jeffrey Koval Jr Mv Kasi

Mv Kasi Donald S Passman

Donald S Passman Ta Nehisi Coates

Ta Nehisi Coates L Randall Wray

L Randall Wray Dale Mayer

Dale Mayer Ibram X Kendi

Ibram X Kendi Ryan Westfield

Ryan Westfield Lecia Cornwall

Lecia Cornwall Cb Samet

Cb Samet Camron Wright

Camron Wright Laurence J Brahm

Laurence J Brahm Tom Wolfe

Tom Wolfe Joshua Bennett

Joshua Bennett Adam Alexander Haviaras

Adam Alexander Haviaras Leena Darling

Leena Darling Elicittheword

Elicittheword Paul Midler

Paul Midler Sachin Kumar

Sachin Kumar Eswar S Prasad

Eswar S Prasad

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Jamison CoxThe Morning Glory of Poetry: An Expansive Exploration of Its Nature, Impact,...

Jamison CoxThe Morning Glory of Poetry: An Expansive Exploration of Its Nature, Impact,...

Glenn HayesThe Chocolate Maker's Wife: A Novel that Indulges Your Senses and Stir Your...

Glenn HayesThe Chocolate Maker's Wife: A Novel that Indulges Your Senses and Stir Your... Theodore MitchellFollow ·13.5k

Theodore MitchellFollow ·13.5k Walter SimmonsFollow ·10.1k

Walter SimmonsFollow ·10.1k David Foster WallaceFollow ·17.5k

David Foster WallaceFollow ·17.5k Eli BrooksFollow ·8.5k

Eli BrooksFollow ·8.5k Jeffrey CoxFollow ·16.7k

Jeffrey CoxFollow ·16.7k Jacob HayesFollow ·19.7k

Jacob HayesFollow ·19.7k Ralph Waldo EmersonFollow ·18.4k

Ralph Waldo EmersonFollow ·18.4k Preston SimmonsFollow ·7.6k

Preston SimmonsFollow ·7.6k

Kelly Blair

Kelly BlairSheppard Lee Written By Himself: A Journey of...

In the realm of...

George Bernard Shaw

George Bernard ShawViper Naga Brides: Unveiling the Enthralling Fantasy...

In the realm of...

Neil Gaiman

Neil GaimanOnce Upon a Hill in Tuscany: A Medieval Short Story

In the heart of medieval...

Preston Simmons

Preston SimmonsBody Bereft: Exploring Loss, Love, and Legacy in Antjie...

A Poetic Requiem for the Lost:...

Percy Bysshe Shelley

Percy Bysshe ShelleyThe Amazing Story Of Robert Smalls Escape From Slavery To...

The life of Robert Smalls is a testament to...

5 out of 5

| Language | : | English |

| File size | : | 417 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 13 pages |

| Lending | : | Enabled |